Pre-Construction vs. Existing Properties: Which Is Right for You?

So you want to invest in Miami’s real estate market, but you are not sure which to choose: pre-construction or existing properties. Both can be very appealing, but let’s figure out which one is best for you.

Whether you're a high-net-worth individual, a real estate developer, or a potential homebuyer, understanding the ins and outs of what makes each option great is crucial. Let's dive into the pros and cons of each to help you make the best decision possible.

The Difference Between Pre-Construction and Existing Properties

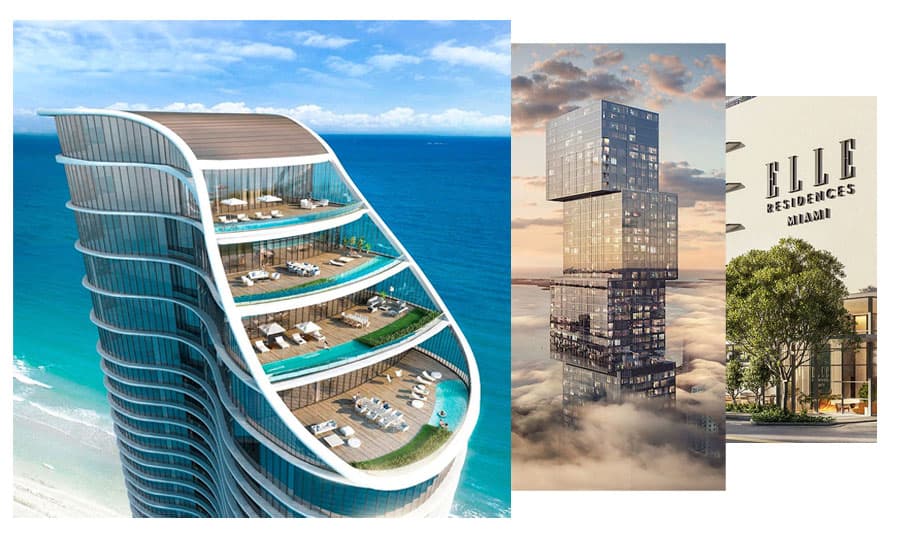

Pre-construction properties are homes that are planned and have been approved for building but haven’t been built yet. Buyers purchase these new developments by looking at the architectural plans, models, and projections that the developers provide.

Existing properties are just as the name states: homes that are already built and are currently available for sale. These properties can be move-in ready or might need a few renovations, but either way, they already exist.

Miami's real estate market is especially appealing to investors because of its vibrant culture, stunning beaches, and booming economy. Whether you choose pre-construction or existing property investments, the city's real estate offers a variety of opportunities for both.

Advantages of Investing in Pre-Construction Properties

There are a lot of exciting new developments entering Miami’s condo market that are sure to pique your interest.

But first, let’s go over the benefits of Miami’s pre-construction real estate:

High appreciation and return on investment: When you buy pre-construction properties, it often means you will buy at a lower price than market value. Then, as the project is built, the value typically goes up, offering a high return on investment.

Option to customize and offer exclusive amenities: When you buy pre-construction, you can usually customize the property to your taste, as well as pick out special amenities like fitness centers, rooftop pools, and concierge services.

Extended payment plans and lower initial costs: Pre-construction real estate usually comes with lower initial costs, and for investors looking to manage their cash flow, they can also utilize extended payment plans.

These are just a few of the many reasons why investing in Miami’s new developments can be such a great investment opportunity.

Advantages of Investing in Existing Properties

Now let’s discuss a few of the reasons why you might want to consider investing in existing real estate in Miami:

Potential for immediate rental income: Since these properties are already built, they can start generating income immediately. This is especially nice if you’re an investor looking to start getting a steady cash flow established.

Well-known neighborhoods and amenities: Buying an existing property means you know exactly what you're getting. Because the neighborhood is already developed, with amenities in place, it can provide a sense of security and stability for potential buyers.

Lower risk: Existing properties have a track record which means you can research past performance, neighborhood trends, and potential for appreciation, reducing your investment risk.

If these reasons align with some of your top priorities, you might want to consider investing in existing properties instead of pre-construction real estate.

Market Dynamics and Trends

The next thing to consider when looking into pre-construction or existing properties in Miami is the market dynamics and trends. They are both influenced by Miami's thriving economy due to consumer spending, population growth, and international appeal.

However, each has unique demand drivers. Demand drivers for pre-construction properties often include the ability to customize the homes and add modern amenities, as well as the potential for higher appreciation.

On the other hand, existing properties attract buyers seeking immediate occupancy and known neighborhoods.

So while pre-construction properties may offer greater long-term value, they also come with risks like construction delays. In comparison, existing properties provide stability and immediate rental income, but they might need renovations and could have higher maintenance costs.

Risk Factors and Mitigation Strategies

Both of these options have their unique risks to be aware of before investing. Let’s review a few possible risks to expect for each.

Pre-Construction Risks

Project delays, market fluctuations, and changes in developer plans could occur. A mitigation strategy for this could be researching the developer's track record and financial health before investing.

Existing Real Estate Risks

Hidden maintenance issues or outdated designs might exist. Conducting a comprehensive property inspection and reviewing the property's history can help mitigate these risks beforehand.

For both types of investments, diversifying your portfolio and staying informed about market trends are key strategies. Consulting with real estate experts and advisors can also provide valuable insights.

Financial Analysis and Investment Strategies

Pre-construction properties often require less upfront investment and offer flexible financing options. However, existing properties provide a quicker return on investment. Looking at your financial goals and working with an advisor can help you find the best option.

Don’t forget the power of diversifying your investment portfolio. By including both pre-construction and existing properties, you can better balance risk and reward. This strategy allows you to receive immediate income while you are also waiting for future appreciation.

It’s also a good idea to understand the taxes for both options, too. Both pre-construction and existing properties have different tax benefits and obligations. Reach out to a tax advisor to help you create an investment strategy that will have your best interests in mind.

Key Considerations for Investors

Whether investing in pre-construction or existing properties, due diligence is so important. Research the location, developer reputation, and all the project specifications.

Remember that real estate markets go up and down. Understanding these cycles and timing your investment accordingly can really impact your returns. You’ll want to get familiar with the prices, trends, and forecast to stay in the know.

Learning about negotiating for pre-construction and existing properties is a valuable skill. Effective negotiation can make all the difference in your investment's profitability and isn’t something to overlook.

Navigating the Purchase Process

The purchase process can be very complex, so let’s briefly break it down for each type of property:

Pre-construction properties: review project plans, negotiate contracts and legal terms with developers, and adhere to specific payment schedules.

Existing properties: property inspection, appraisal, and legal negotiations with sellers and real estate agents.

Be sure to seek out professional guidance from real estate agents and advisors for both pre-construction and existing properties. Their expertise can help you make informed decisions and navigate complex real estate transactions, especially if you’re a first-time homebuyer.

Browse Miami Pre-Construction Projects Right Here on OpMiami.com

Investing in Miami's real estate market, whether through pre-construction or existing properties, comes with its own set of advantages and disadvantages.

By understanding the market dynamics, practicing due diligence, and using strategic investment approaches, you can maximize your returns and achieve your real estate investment goals.

As Miami continues to grow and evolve, both pre-construction and existing properties present amazing opportunities for investors. Stay informed and strategic to watch your investment grow and thrive in this vibrant market.

Take the time to browse pre-construction projects in Miami right here on OpMiami.com. Get started for free!